Berkshire Hathaway continues to expand its asset portfolio

Berkshire Hathaway company bought back its own shares for a record $9 billion. Class A papers cost $2.5 billion and Class B papers cost $6.7 billion.

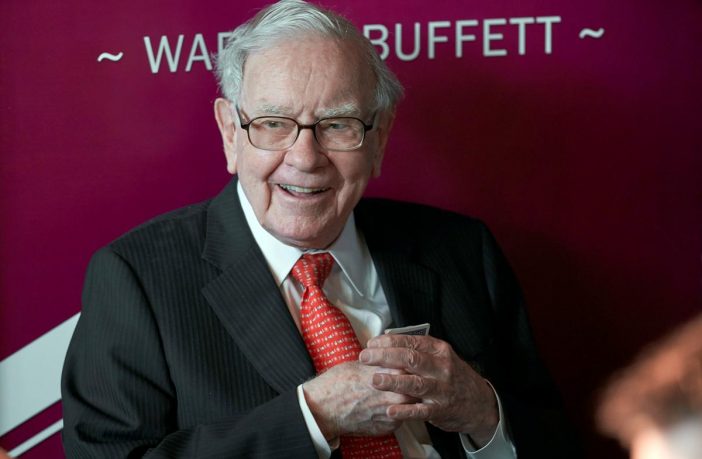

The investment holding company, which Warren Buffett founded, has been buying its securities for several consecutive quarters. The corporation took such a step because of the pandemic and its negative impact on the economy. Many companies, which are part of the holding, suffered large losses last year. Especially critical situations are observed in insurance and railway directions, as well as among utility providers.

In total, in 2020 Berkshire spent 15.7 billion dollars to buy back its own shares. In the fourth quarter of last year, the holding’s operating profit fell by 30% to $5.5 billion. However, despite the difficult 2020, net profit increased by 82% to $30.1 billion. The company received most of this amount thanks to investments in Apple Corporation, whose profit increased by 26% only in the fourth quarter.

Last summer Berkshire acquired a part of the shares of Bank of America, the second largest financial institution in the United States. In total, 34 million securities were purchased for a total of 800 million dollars. This allowed Warren Buffet Holding to increase its share in the bank to 11.3%. According to U.S. law, when holding a package of assets in excess of 10% of the total amount, it is necessary to coordinate the transaction with regulatory authorities. Berkshire passed the Federal Reserve inspection and only after that was able to purchase the bank’s securities. Last year, the holding had to get rid of a number of assets, including shares in financial institutions. Berkshire sold a part of shares to JPMorgan, BNY Mellon, Goldman Sachs and others.

Buffet`s Company decided to expand its investment in the Japanese market. It acquired shares in such large corporations as Itochu, Mitsubishi, Marubeni and others. Immediately after the announcement of the acquisition, the value of these companies increased by 5% on average.

Japanese corporations are interesting from the point of view of the spheres of activity they are engaged in. Each has investments in the energy, technology, mining and trade sectors. Such a step by Berkshire shows the intention of the company to diversify its asset portfolio to minimize losses during the crisis in a particular market sector. In addition, the U.S. holding company has been cooperating with Japanese partners for a long time, so the purchase of shares in them became a natural stage of their partnership.