Reserve Bank of India reduced reverse REPO rate

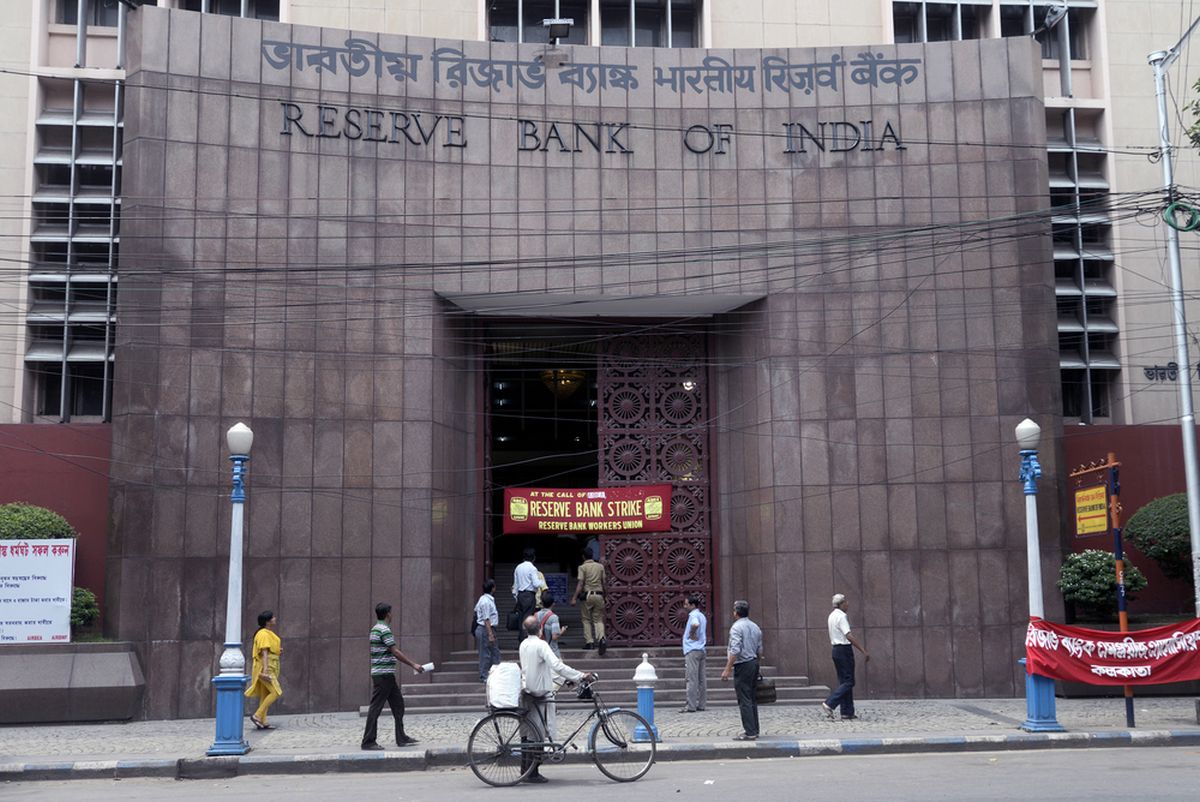

The Coronavirus pandemic has severely hit India’s economy, and the government is now actively developing measures to stabilize the situation and minimize damage. Last week the Reserve Bank of India held a meeting, as a result of which it was decided not to raise the interest rate, but to reduce the reverse REPO. In addition, the country’s main financial regulator is introducing a number of measures aimed at maintaining the segment’s liquidity until the pandemic and its limitations are eliminated.

As a result of the meeting, it was decided to keep the base interest rate at 4.4 percent per annum. The reverse REPO rate has been reduced by 25 bp and now stands at 3.75%. The reduction of the latter indicator was made so that commercial banks would reduce the amount of capital they place in RBI. Thus, institutions will direct these funds to lending to companies and consumers.

In addition to these changes, the Central Bank plans to allocate about $6.5 billion to support corporate bonds. For this purpose, another round of targeted repo operations, aimed at the long-term perspective, will soon be held.

The Reserve Bank has also revised and relaxed its claims regarding the provision of loan loss reserves for financial institutions. The Central Bank also recommended suspension of dividend payments. This will preserve assets that may be needed in the event of severe damage and neutralize the impact of the Coronavirus pandemic. Dividend payments have so far been frozen until the end of the current financial period, and the CBR will review this point further. This will be tentatively done at the September meeting.

According to the specialists of the Reserve Bank, in the current situation it is extremely important to keep a part of the capital at the financial institutions in order to direct them afterwards to recovery of the country’s economy.

Experts expect inflation to fall below the mid-term forecast from the Central Bank, which claimed 4%. In March, it was 5.9%. In the second half of this year, positive changes are expected, which will allow RBI to take advantage of the situation and stabilize a number of processes.

However, analysts do not rule out the possibility that the Central Bank of India may soon revise the base interest rate and reduce it. The last decline was in March, when it changed by 75 bps to 4.4%, which was a record low for the last 10 years.

In addition, the issue of the crypt currency was also raised. The Reserve Bank plans to appeal against the decision of the Supreme Court of the country, which allowed digital currency transactions. According to the Central Bank, this could jeopardize the entire banking system.