Fintech Farm has held a funding round

In April 2023, Fintech Farm held a funding round in which it raised US$22 million. The leading investor was the Nordstar fund. Experts believe the valuation of the neobank deployment platform could exceed US$100 million.

The current funding round was the second for the company, incorporated in the UK in 2020. The first took place in early 2022 and raised US$7.4 million. Investors then included Flyer One Venture Fund, fintech Solid, and an African marketplace.

Fintech Farm was founded by three businessmen: Mykola Bezkrovny, Oleksandr Vityaz and Dmytro Dubilet. The latter is famous for creating the Monobank online banking service. The platform allows the launching of Internet banking in partnership with traditional financial institutions.

Mobile banking based on the platform:

– Leobank;

– Liobank;

– Fibo.

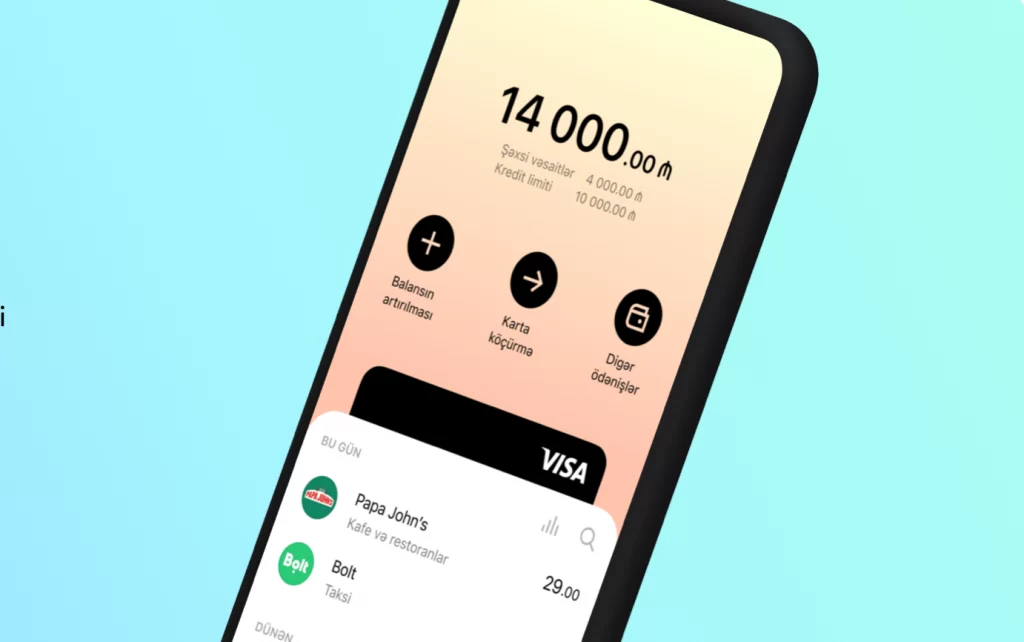

The first Fintech Farm-based project is Leobank in Azerbaijan. It was launched in cooperation with the local Unibank. The application has about 1 million users. The project is already profitable.

Liobank is operating in Vietnam. It is still at the testing stage in two major cities in the country, Hanoi and Ho Chi Minh City.

Fibo is a non-banking solution designed specifically for Nigeria. It is also still in the testing phase and is available to Lagos residents.

The attractiveness of neobank to investors

The company focuses primarily on Asia and Africa, but management plans to expand its geographic reach. The company plans to launch ten projects in different countries in the medium term.

The funding round used the convertible loan mechanism, which the venture capital market considers quite popular when investing in promising start-ups. This approach implies that investors’ funds will be converted into company shares not in the current round but in the next one. The main argument for investments is the success of the Leobank project, which generates income and has a high rating among users.

According to Dmytro Dubilet from Fintech Farm, mobile banks based on the platform are functional and attractive to users. Every detail involved in the project’s launch is thought through, considering the target audience’s preferences. This makes it convenient for customers to use the app and enjoyable.

The fintech app model assumes the possibility of lending to a traditional financial institution, so each app has a partner bank in every country. It is selected according to several criteria. First and foremost, it must be a reliable and large business.

Despite excellent prospects and current successes, experts are somewhat cautious in predicting the future of Fintech Farm. Their main argument is the instability of the global banking system, which may limit the company’s development.